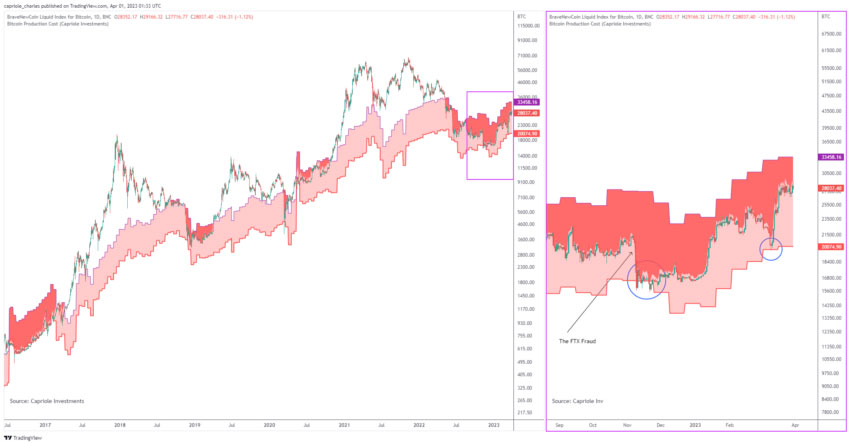

Charles Edwards, the founder of Capriole Investments and an analyst, has expressed his belief in the growth prospects of Bitcoin. In a microblog post, he shared his bitcoin forecast and provided arguments supporting the increase in the coin’s price. Edwards drew attention to a graph that shows how Bitcoin behaves in response to changes in its mining cost. According to him, the cryptocurrency tends to rise every time it touches the bottom of the “cloud,” which represents the approximate cost of mining the coin and is marked in red on the chart.

He also noted that Bitcoin typically breaks through the lower edge of the “cloud” when miners start losing money. The graph indicates that the most recent instances of Bitcoin surpassing the breakeven point occurred during the collapse of the FTX crypto exchange in November 2022 and regulatory pressure on the Binance exchange in March 2023. Edwards considers the comparison of Bitcoin’s rate and the cost of mining to be his most reliable long-term indicator for BTC.

Drawing on data from Trading View, Charles Edwards highlighted how Bitcoin’s behavior is impacted by changes in mining costs. Additionally, he noted that indicators show that Bitcoin is currently trading 33% below its “fair” value, with the last time it reached a similar level being during the “crypto winter” that followed its peak of $20,000 in December 2017. Despite being a significant distance away from breaking the curve that indicates the “fair” value of Bitcoin, the history of the coin’s behavior suggests that approaching this curve may signal the onset of a new phase of substantial growth.

A visual representation of Bitcoin’s estimated fair value can be seen in a graph that displays a red curve. This curve serves as a reference point for determining whether the cryptocurrency is currently trading above or below its perceived fair value. It’s worth noting that the fair value of Bitcoin can be impacted by various factors, such as changes in mining costs, government regulations, and global economic conditions.

Bitcoin overtakes US dollar in terms of purchasing power

Experts predict that the US dollar’s status as the dominant currency in the world market will diminish in the near future. According to Finbold, the purchasing power of the USD has declined significantly, dropping from 300 to 33.2 points (an 88.9% decrease) since 1960. In contrast, Bitcoin’s purchasing power has increased from 33 to 255 points (a 672.7% increase) since 2010.

Despite there being no clear signs of an impending recession in the US economy, many economists remain concerned about the possibility of a major financial crisis that could even surpass the Great Depression. Bloomberg’s senior strategy analyst, Mike McGlone, is among those who hold this view.

Bitcoin has traditionally exhibited a negative correlation with the US dollar. However, this relationship has weakened from -60% to -23% since the start of this year. This suggests that the flagship cryptocurrency is becoming less reactive to price fluctuations in the US dollar.

Bitcoin has surged to nearly $28 thousand, marking a gain of over 27% in the past week, with buyers maintaining control of the market. Numerous experts predict that the cryptocurrency will continue to reach new heights.

Crypto analyst Bob Lucas recently tweeted about the market dynamics of Bitcoin, suggesting that if the coin surpasses $34 thousand in the near future, it could serve as a reliable springboard for further growth. He also noted the growing interest in Bitcoin from institutional investors.

Large holders and financial companies are increasingly becoming interested in the cryptocurrency gateway, partly due to the banking crisis in the United States.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc