On April 13, Ethereum’s main network underwent the Shapella update, which was activated by the developers. This upgrade is expected to reduce risks for investors and will likely have a positive impact on the Ethereum exchange rate in the long term.

This hard fork, which took place at epoch #194 048, allowed users to withdraw their cryptocurrencies from staking. Although there were a few missed blocks during the process, the overall update was successful and the blockchain remains stable.

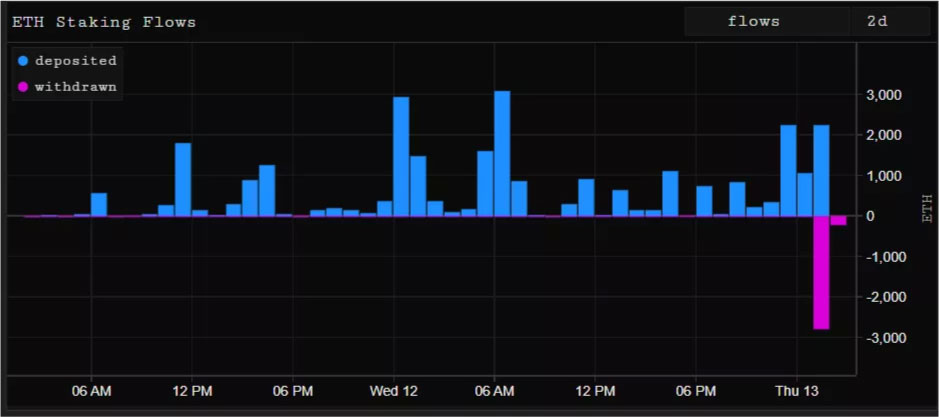

The Shapella hard fork is a significant step in the Ethereum roadmap, following The Merge, and involves changes to both the consensus and execution levels. Its main objective is to enable the withdrawal of ETH from staking, which has already begun. Validators have unlocked over 3100 ETH, while the deposit contract continues to receive more cryptocurrency.

Validators will be granted access to unfreeze stake nodes either partially or fully. At present, a substantial amount of capital is locked in Ethereum staking, which is illiquid. Shapella aims to “open the gates of liquidity,” which Lido, a DeFi platform, considers the most significant and beneficial aspect of the hard fork.

Prior to Shapella, the amount of Ethereum in stake nodes could only increase; however, now it can be withdrawn. This presents the opportunity to redistribute assets between new and existing staking products and eliminates significant uncertainty, enabling staking to be “fully functional.”

Consequently, this is expected to promote growth in the number of services and users. Furthermore, Shapella will enhance smart contract operations and network commissions while reducing block creation costs.

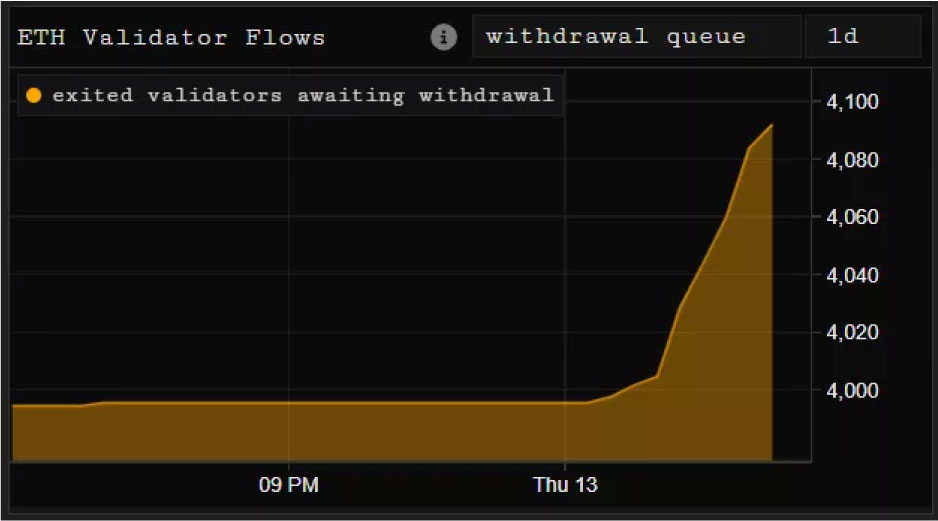

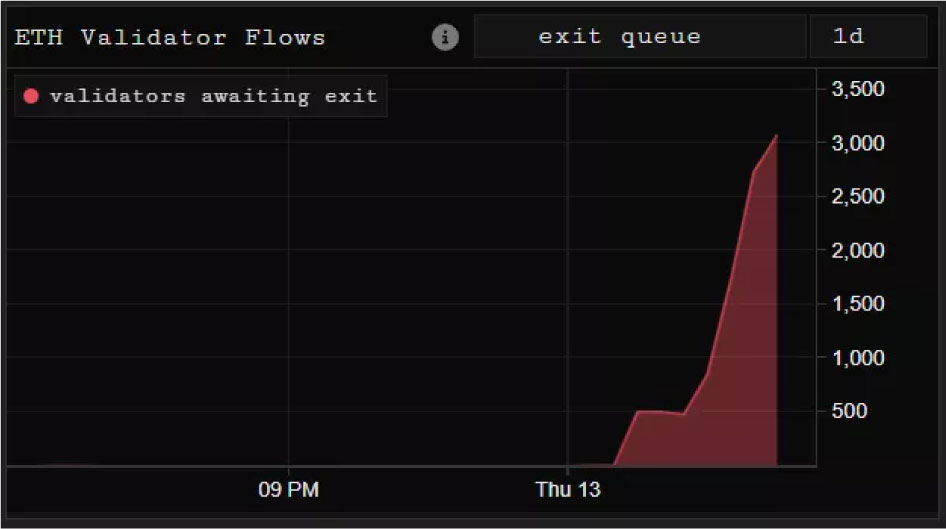

Since the hard fork’s implementation, the blockchain has processed withdrawals, both full and partial, for 8835 ETH (~$16.96 million at the current exchange rate), with more than 4,000 validators waiting for withdrawals, and over 3,000 validators in the queue.

The upcoming hard fork will introduce minor improvements at the EVM level, including the addition of the PUSH0 instruction, which has been long overdue, and reducing the cost of accessing the miner’s wallet address. It also prepares the network to abandon the smart contract deletion mechanism, as expired addresses continue to receive transactions, resulting in the loss of both gas and money. The developers have also decreased gas costs for specific transaction types, enhanced blockchain data storage, introduced EVM-related enhancements, and introduced new cryptographic primitives.

How will Shapella affect the price of Ethereum?

While the activation of Shapella caused volatility in Ethereum quotes, no significant price changes occurred. On the one hand, the ability to unfreeze and sell ethers may increase supply, but on the other hand, a fully functioning PoS could generate enthusiasm for the system and fuel a media surge, leading to increased demand.

However, the developers have established a dynamic system that prohibits the withdrawal of all funds at once, implying that any effect on the cryptocurrency price will be negligible.

Shapella represents a significant step towards enhancing scalability and efficiency in the Ethereum network. Despite potential short-term market fluctuations, the ecosystem will benefit significantly in the long run through increased crypto transaction processing speed, reduced transaction costs, and improved smart contract security.

According to experts, the Shapella update will revolutionize the liquid staking landscape, making Ethereum the standard for cryptocurrency payments. Direct and liquid staking solutions are expected to play a more substantial role in the cryptocurrency space.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc