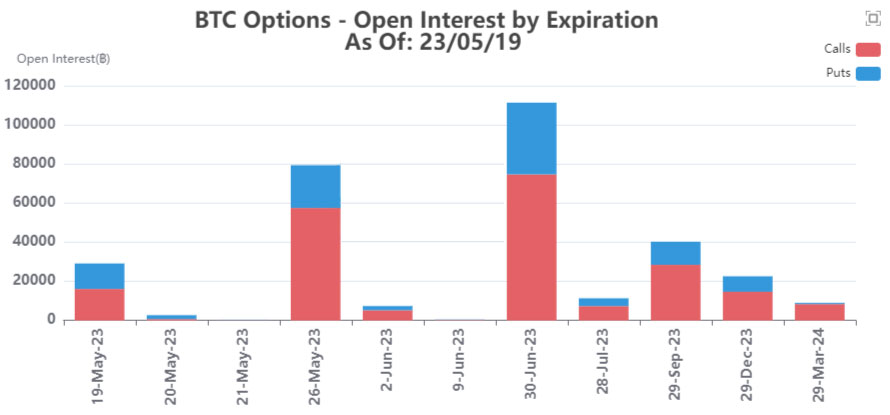

The BTC economic calendar of the cryptocurrency market is marked by a noteworthy event today (19 May 2023), as a significant number of Ethereum and Bitcoin options are set to expire. This occurrence is expected to have a substantial impact on price movements within the cryptocurrency platform. Bitcoin, being the leading digital currency, currently has around 29,000 options awaiting expiry.

Additionally, the batch of Bitcoin options currently under consideration exhibits a put/call ratio of 0.81. This ratio is calculated by dividing the number of put (short) contracts traded by the number of call (long) contracts traded. A put/call ratio below 1 indicates a bullish sentiment, suggesting that more traders are inclined towards buying long contracts rather than short ones. It’s worth noting that Deribit, a prominent platform, reports a total open interest of 308,044 contracts, referring to the overall number of active contracts that have yet to reach their expiration date.

BTC and ETH options expiry

Moreover, these options provide derivatives traders with the ability to purchase or sell Bitcoin contracts at a specific price known as the strike price, which is set to expire on a predetermined date. One notable advantage of options is their flexibility compared to futures contracts, as they offer customizable expiry dates rather than fixed ones.

The maximum pain value represents the price level at which the largest number of open contracts would result in significant losses upon expiry. It serves as an important reference point for market analysis.

Prepare for price swings

However, there is more to come. Ethereum is also poised for a similar event, with a significantly larger number of options on the verge of expiry – precisely 169,000 contracts. These contracts hold a Put Call Ratio of 0.96, and the maximum pain point is positioned at $1,800. Exploring the notional value of these Ethereum contracts reveals a staggering $310 million.

The expiration of these contracts should not be underestimated, as it has the potential to act as a catalyst for short-term volatility in the cryptocurrency market, potentially impacting the prices of Ethereum. Moreover, these fluctuations may even reverberate through other cryptocurrencies, subtly altering their trajectory.

Investors, traders, and market observers should prepare themselves for possible price fluctuations and consider adjusting their investment and trading strategies accordingly. The cryptocurrency market, renowned for its dynamic nature, might experience a shifting landscape in light of these forthcoming events.

As always, having access to accurate information holds significant power in this fast-paced industry. Staying informed about such events is crucial for navigating the unpredictable waters of cryptocurrency investments.

Participants in the market should be prepared to face these impending events. The cryptocurrency space is expected to experience volatility in the near term, which will have an impact on the price movements of BTC and ETH. It’s important to remember that the price actions of these leading tokens often have a ripple effect on the entire crypto industry, ultimately shaping the trajectory of the market.

Crypto enthusiasts need to be ready for potential price fluctuations and be open to adjusting their trading strategies accordingly. It’s worth noting that today’s events have the potential to reshape the cryptocurrency solutions, considering the ever-changing nature of the industry.

Remaining well-informed continues to be crucial in this dynamic industry. Traders, investors, and market observers should stay updated on upcoming market events that could influence price movements. This is particularly important given the unpredictable nature of the crypto market.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc