The Bored Ape Yacht Club has experienced a tumultuous ride in recent days, evoking a whirlwind of emotions. Numerous investors decided to part ways with their prized blue-chip NFTs, igniting a surge of Fear, Uncertainty, and Doubt (FUD).

Bored Ape Yacht Club

BAYC has faced significant challenges as the bear market finally made its presence felt, resulting in several holders offloading their NFTs and subsequently diminishing the overall value of these digital assets.

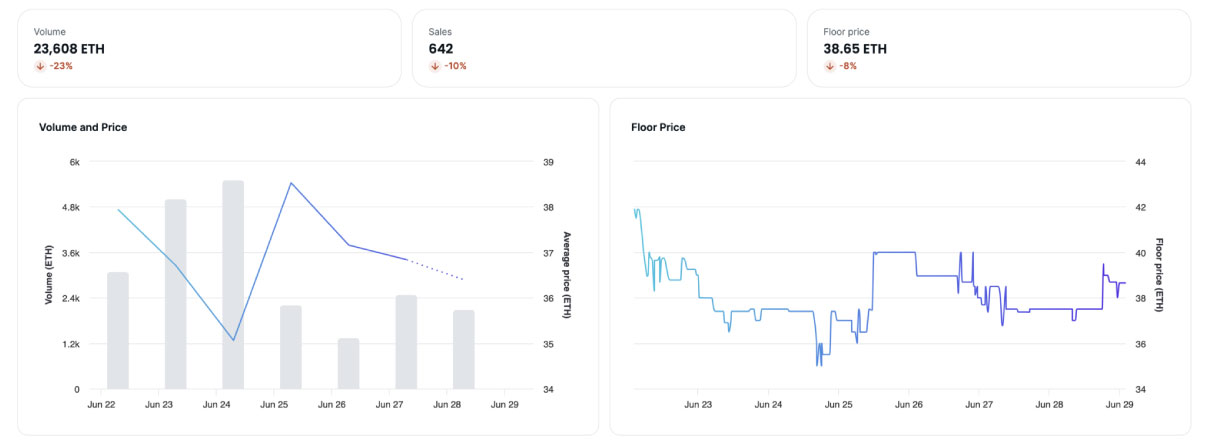

In the past few weeks, the Bored Ape Yacht Club has witnessed substantial losses, with the floor price plummeting by over 19% when measured in ETH over the previous 30-day period. Acquiring a Bored Ape now requires 36.5 ETH.

The downward spiral of the BAYC collection can be attributed to a variety of fundamental factors. Factors such as general market pessimism, perceived decline in utility, large-scale sell-offs by influential investors, and waning media attention have all played a role. However, those in the know are of the opinion that recent activities within the Blur ecosystem have exerted the most significant overall influence.

Renowned NFT collector Jeffrey Huang, also known as Machi Big Brother, sparked a frenzy surrounding BAYC NFTs. Huang’s series of sales and subsequent acquisitions from the collection generated considerable instability in the NFT’s price.

According to statistics from Blur, a well-known NFT marketplace, Huang sold around 50 Apes. In a single transaction last Saturday, he sold 19 Apes for 651 ETH, equivalent to almost $1.2 million at the time of the sale.

ApeCoin (APE), positioned as the core asset of the world’s most valuable NFT ecosystem, hit an all-time low of $1.936 on June 19, experiencing a decline of more than 90% from its peak before eventually rebounding.

Analyzing BAYC’s OpenSea statistics unveiled an intriguing trend. From May until approximately June 18, the NFT maintained a relatively stable floor price, averaging around 45 ETH. As of now, the floor price stands at approximately 38.6 ETH, indicating that a recovery is underway. This development suggests a positive correlation between increased social interaction and price stabilization, potentially signaling a future crypto payments.

However, based on the current market assessment, this recovery level still falls short of enticing short-term speculators to consider holding their positions. A rally to the 40 ETH price level might be supported by players awaiting a bullish signal, as the current price level fails to meet the aforementioned requirements.

Conclusion

The Bored Ape Yacht Club has experienced a turbulent period marked by significant sell-offs, diminishing NFT values, and a general sense of uncertainty in the market. Various factors such as market pessimism, decreased utility perception, influential investor sell-offs, and diminished media attention have contributed to the club’s challenges. Notably, the actions of NFT collector Jeffrey Huang, also known as Machi Big Brother, have had a considerable impact on the instability of BAYC NFT prices.

While recent data suggests a potential recovery with a gradual increase in social interaction and a stabilization of floor prices, the current crypto market situation indicates that the recovery level may not be sufficient to attract short-term speculators. Further price rallies to the 40 ETH level may be anticipated as players await bullish signals. However, caution is advised as the current price level does not meet the necessary requirements for speculative investments.

Overall, the Bored Ape Yacht Club continues to navigate through a challenging period, and its future trajectory will depend on various market dynamics, investor sentiment, and developments within the broader NFT ecosystem.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc