The retail sector is currently witnessing a monumental shift towards digitalization, primarily driven by the adoption of cryptocurrency payment gateways. Innovations like PTPShopy are at the forefront, revolutionizing financial transactions and providing retailers with a significant advantage in the rapidly evolving digital economy.

This shift marks a pivotal moment for retail businesses, urging them to embrace digital payment methods that align with modern consumer preferences and technological advancements.

The Rising Tide of Crypto in Retail

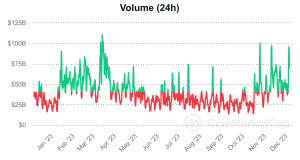

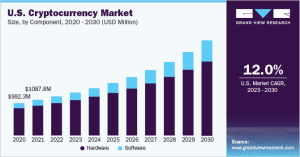

The growing influence of cryptocurrency in the retail sector is undeniable, with its market capitalization reaching a staggering $1.71 trillion as of January 1, 2024. This surge reflects not just an investment trend but a paradigm shift in consumer payment preferences.

Retailers, by integrating these gateways, can capitalize on this emerging market, securing a significant position in the digital currency landscape. As of 2023, over 425 million users globally have embraced crypto, making its impact global.

Interestingly, the distribution of crypto users across continents reveals a more nuanced picture of its global reach. In 2023, Asia led with over 265 million users, followed by North America, Africa, and South America alongside Europe, each with substantial user bases. India leading the charge with 94 million crypto holders, United States follows with over 47 million crypto users.

This widespread adoption indicates a vast, untapped market waiting to be explored by forward-thinking retailers.

Unlocking New Revenue Streams Through Crypto

The sharp rise in global crypto usage opens up new avenues for revenue generation for businesses. It’s becoming increasingly important for companies to consider adding cryptocurrency as a payment option to cater to this growing demographic.

According to Josh Howarth at Exploding Topics, merchants (offline and online) who have adopted crypto payments have witnessed a remarkable average ROI of over 250% and a customer increase of up to 26%.

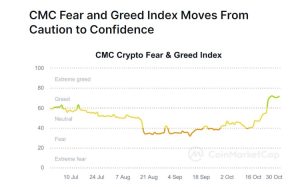

A study conducted by JPMorgan explains the robust inclination of the retail sector towards Bitcoin, especially as we approach the forthcoming halving occurrence slated for April 2024. This research attributes the increased retail enthusiasm, in part, to the dawn of Bitcoin and BRC-20 tokens. The impending halving, poised to cut mining rewards, is anticipated to escalate Bitcoin’s value to an estimated $40,000, thereby fostering a positive psychological effect on potential buyers and the usage of cryptocurrencies in retail.

Analysts at JPMorgan state that, historically, the production cost acted as a boundary for the price of Bitcoin and other currencies. It’s noteworthy that prior halving events, specifically those in 2016 and 2020, led to a bullish phase in Bitcoin and other cryptocurrencies.

Integration of cryptocurrency payment solutions unlocks a future-minded target audience. Over 420 million global crypto users, as reported in 2023, represents a diverse and growing customer base.

This shift is not just a trend but a strategic move to tap into a diverse and expanding market segment, offering significant opportunities for growth and market expansion. Retailers employing gateways like PTPShopy can effectively tap into this expanding market.

Reducing Costs and Enhancing Security

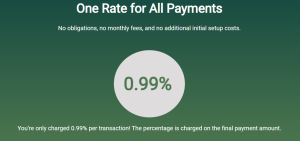

With blockchain’s decentralized nature, transaction costs are minimized, a benefit accentuated by platforms like PTPShopy. It is important to note that although most payment gateways state that they charge a low transaction fee, traditional payment gateways often have hidden fees, including withdrawal and processing charges, which can inflate the overall cost.

If the payment gateway states that they charge only 0.5% transaction fee, by the time the transaction fee is deducted, the withdrawal fee is added, and potentially even the service fee; you’re looking at 1.5%.

PTPShopy, however, stands out by charging a flat fee of 0.99% per transaction from the customer’s end. This cost efficiency, coupled with the enhanced security provided by blockchain technology, makes cryptocurrency payment solutions a highly attractive proposition for modern retailers seeking to optimize operational costs and improve transaction security.

Global Reach and Instant Transactions: The Crypto Advantage

The unique feature of cryptocurrencies is their lack of geographical boundaries, allowing retailers to tap into a global customer base with instantaneous transaction capabilities. As the crypto landscape matures, it has been shaped significantly by regulatory and compliance procedures, impacting users and platforms worldwide.

Cryptocurrencies are legally – or illegally, depending on the local regulations – being used all over the globe in business, for investment purposes, and amongst friends and family.

As it has been almost a decade since we saw our first crypto pump alongside blockchain hitting mainstream media, regulatory and compliance procedures have substantially impacted the crypto community.

Most crypto platforms now require KYC procedures to align with anti-money laundering and anti-terrorist financing regulations, reflecting the industry’s evolution towards greater accountability and security.

KYC procedures apply to most platforms, no matter if its an exchange, wallet, payment gateway, or even a fully decentralized platform. We highly recommend avoiding decentralized platforms as no one takes on liability for transactions, operations of the platform and nodes, and no one will be held liable for user funds if the platform ‘mysteriously’ shuts down.

Strengthening Customer Loyalty

The convenience and modern appeal of crypto payments, as facilitated by gateways like PTPShopy, significantly enhance customer retention and satisfaction. Research by Exploding Topics highlights that integrating a crypto payment gateway can lead to an impressive increase in customer base, which can be a game-changer for businesses.

This surge in customer engagement and loyalty can transform businesses from uncertain futures to potential market leaders, eyeing IPOs and significant market expansion.

The Global Landscape of Crypto Adoption

Crypto offers an opportunity for retailers, both online and offline, to connect with a diverse demographic segment. The following stats are the percentage of a nations population that uses cryptocurrencies:

India – 6.54%, United States – 14.40%, Philippines – 13.42%, South Africa – 10%, Mexico – 3.38%, France – 5.91%, Turkey – 5.46%, Germany – 4.19%, and so on…

These stats may appear as just percentages on a screen, but they encompass tens of millions of potential customers that your business can target.

High crypto adoption rates in various countries demonstrate the widespread appeal of digital currencies. Retailers can tap into these diverse demographic segments, offering a competitive edge over competitors still reliant on traditional fiat currencies and outdated business practices.

This global landscape presents a vast array of opportunities for retailers to connect with new customer bases, expanding their reach and adapting to future market trends.

Businesses Embracing the Cryptocurrency Wave

As cryptocurrency gains mainstream acceptance, over 15,000 businesses globally, including a notable presence in the U.S., are now accepting crypto payments.

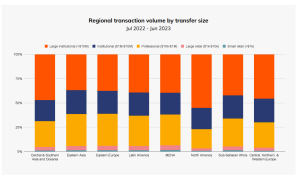

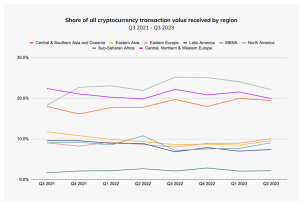

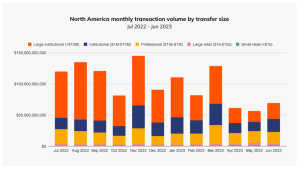

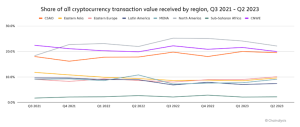

Source: Chainalysis

This trend is not just a fleeting moment but a significant shift in consumer and business transaction preferences. The critical question for businesses is how to position themselves in this evolving landscape and leverage the opportunities it presents.

Where will you be part in this trend?

A Forward-Thinking Move: Embracing Crypto Payment Gateways

Adopting a cryptocurrency payment gateway like PTPShopy is a strategic and forward-thinking decision for retailers. The company also offers PTPWallet, a crypto wallet developed specifically for retailers. Such solutions align with current market dynamics and pave the way for growth, enhanced customer satisfaction, and increased revenue.

Focusing on ease of use, security, and low transaction fees, PTPShopy exemplifies why numerous businesses are keen to integrate such innovative payment solutions, thereby revolutionizing their business models in the digital economy.