The Canadian e-commerce market, where consumers and businesses can buy and sell products and services exclusively through electronic channels, has continued to rapidly develop in the past decade. Millions of Canadian dollars are now being transacted daily through numerous cryptocurrency payment gateways which have saturated the market.

Choosing the right payment gateway is critical to both business owners and consumers, especially as the world tilts towards a cashless environment. Hence, we will look at some of the best gateways used by merchants in Canada in 2024.

What is a Payment Gateway?

A payment gateway is a technology used by merchants to facilitate transactions. It usually accepts credit or debit card information, as well as a crypto wallet and serves as a middleman between the financial providers of both parties. To ensure ease, merchants integrate these cryptocurrency payment gateways into their online stores so that customers can make payments at any time. Payment gateways are also employed in brick-and-mortar stores in the form of scannable QR codes, physical card-reading devices, or Near Field Communication (NFC) technology.

How To Choose the Best Payment Gateway

Payment gateways are essential for business payments as they ensure the circulation of funds from customers to merchants. Before you choose a payment gateway, it’s important to consider certain features.

Pricing & Fees

Business owners looking to make a profit must consider the pricing tiers of their chosen payment gateway. Many gateways offer free financial services, while others require subscription fees. It’s important to know how much these fees cost in total and how much you are likely to make each month to ensure you operate profitably. The average merchant is expected to pay around $25- $50 per month for subscription fees and around 3% per transaction for payment processing fees.

Security

The security of your chosen payment gateway should be a top issue. Ensure your payment gateway is PCI-compliant and employs fraud prevention measures to protect your user’s financial data as well as credit card information from theft. You can perform a background check on your chosen payment gateway to check for past or possible security breaches.

Best Payment Gateways In Canada in 2024

There are thousands of payment gateway providers in Canada, yet only a few are being used by millions of Canadian merchants. Usually, these popular payment gateways offer the best financial services and can be integrated easily into online and e-commerce stores. The following are some of the best payment gateways merchants use in Canada

PTPShopy

PTPShopy is a crypto processing gateway for merchants and business owners interested in expanding their payment options. It acts as a middleman and processes transactions for merchants via regular cryptocurrency transactions and virtual PoS payments. You can also access additional financial services such as crowdfunding and donations on the PTPshopy website.

Features: It is gaining wide popularity for its scalability and ease of integration. PTPShopy offers many benefits, as well as, digital financial tools that can help during invoicing, calculations, and even taxation. The low transaction fees and fast payment processing and confirmation have made PTPShopy a favorite for many merchants in Canada.

Alongside, PTPShopy offers 400+ cryptocurrencies and also provides user-friendly plugins for easy inclusion or integration with e-commerce stores. Unlike other payment gateways, PTPShopy charges only a 0.99% transaction processing fee, allowing business owners to make more profits.

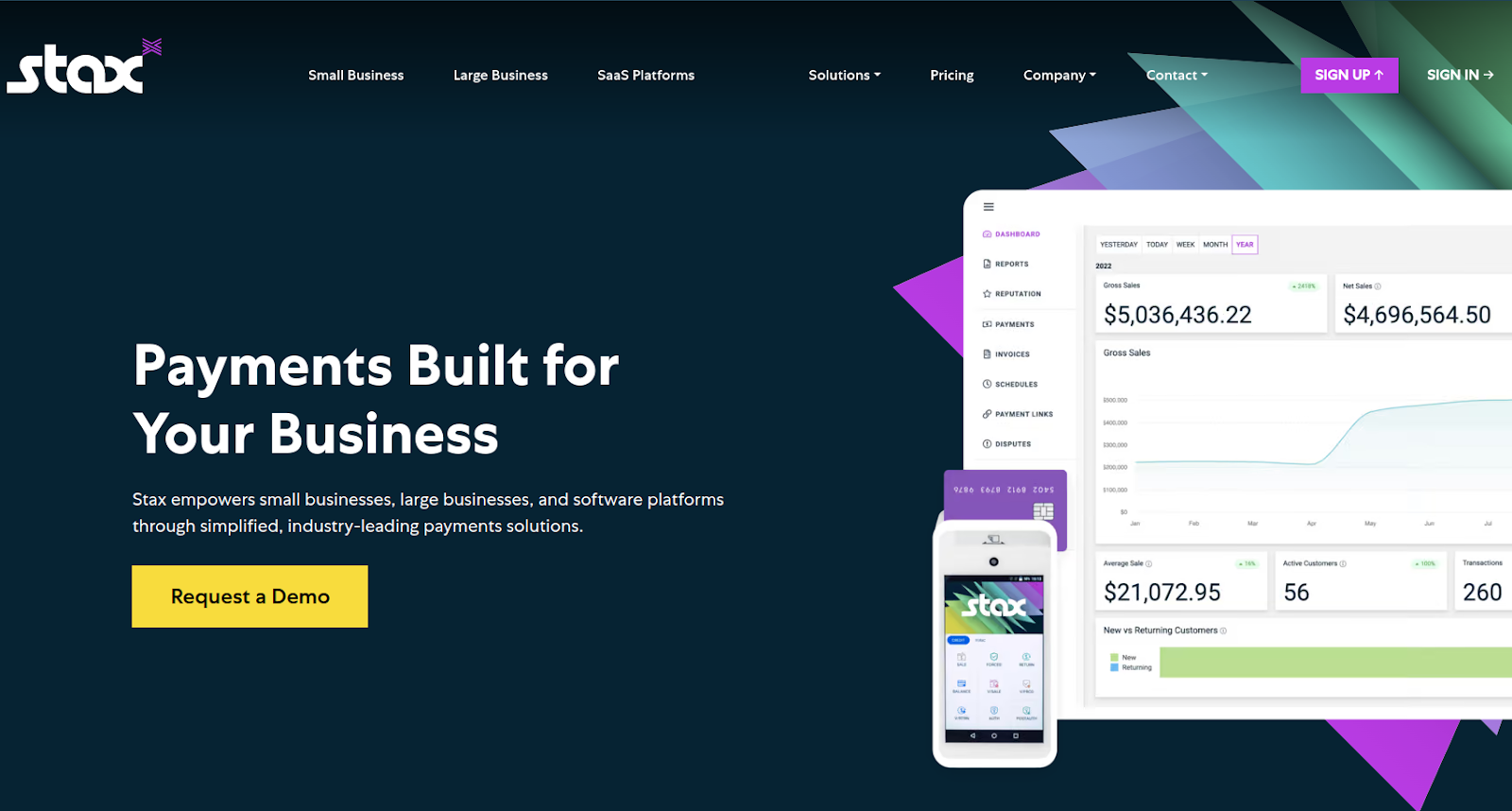

Stax Payment

Stax is popular in Canada because it offers low payment processing rates for wholesalers. It also has a different subscription-based pricing structure that allows merchants to choose a plan suitable for their budget. Stax offers many financial tools that allow you to track your refunds, run reports, and show your gross monthly sales.

Features: Stax is a popular payment gateway that offers a highly functional credit card processing platform. It allows businesses to use its standard POS hardware to facilitate payment in their brick-and-mortar stores and also features a virtual terminal that can be integrated with any computer, tablet, or phone.

Drawbacks: Although Stax offers different pricing plans, they can be quite expensive for businesses just starting. For instance, their basic “Growth” plan costs $99 a month while the “Ultimate” costs $159 a month. In addition to their monthly subscription fee, Stax charges a credit card processing fee of around $0.08 – $0.15. Alongside all these fees, you get charged a noncompliance fee of $54.99 if you defy their established security measures, and a $25 below-quota processing fee if you do not process up to a certain amount every month.

Helcim

Helcim is another payment solution for businesses that facilitate contactless payment for both physical and online stores. It can process payments from almost every major card brand and comes along with additional perks. These perks include automatic discounts, depending on your total monthly sales. They charge an average of 2.49% plus $0.25 for every online transaction and 1.93% plus $0.08 for every in-person transaction.

Features: It offers automatic and personalized services for merchants. There are no monthly fees, contracts, or additional hidden charges with Helcim. Although Helcim charges $15 for every chargeback, they will reimburse your $15 if you successfully dispute the chargeback.

Drawbacks: Getting approved can be quite difficult as Helcim requires every prospective merchant to provide detailed information about what you sell, your projected average monthly sales, and any additional history to evaluate your business’ risks. Only after being approved can you gain access to Helcim hardware and software alternatives, as well as financial tools.

Stripe

Stripe Payments is a popular payment processing platform that offers numerous, customizable payment options. It is a top-leading payment processing company and payment service provider (PSP). It does not offer merchants individual accounts, rather the accounts are compiled into one large merchant account that allows businesses to process mostly card-based transactions both online and offline.

Features: Stripe employs a pay-as-you-go model for pricing that allows merchants to cancel anytime they like. There are also more monthly fees, asides from the regular transaction processing fees. For commercial transactions, they charge 2.9% + $ 0.30 per transaction and 2.7% + $0.05 per transaction for in-person transactions through the Stripe Terminal. They also process ACH (bank-to-bank payment) and support Buy Now, Pay Later payment methods.

Drawbacks: Stripe payout timing for non-high-risk industries in Australia and in the United States is 2 business days. It’s also important to know that your first payout will take 7 to 14 days and may even take longer for merchants in other countries.

Use PTPShopy To Receive Crypto Payments!

Use the PTPShopy cryptocurrency payment gateway to receive crypto payments from your customers. It supports over 400 cryptocurrencies with low fees. Compatibility with 10+ eCommerce websites including WooCommerce and Shopify.