The Chicago Mercantile Exchange (CME) is about to see the expiration of its Bitcoin options contracts. As this happens, BTC is encountering significant resistance at its current levels, which begs the question: will it withdraw?

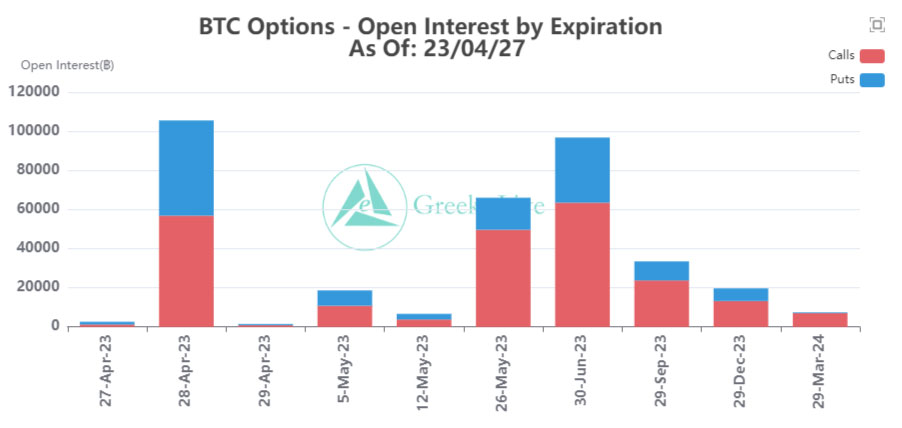

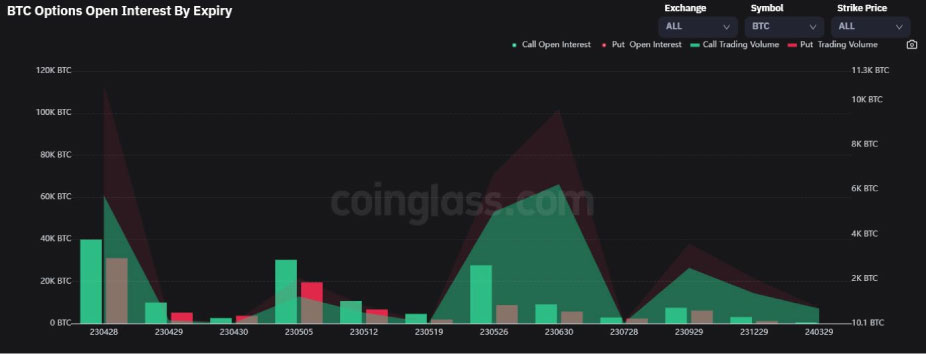

The impending Bitcoin options expiry involves a substantial number of contracts, totaling 105,000 BTC, and carries a notional value of $3.1 billion. Additionally, there is a maximum pain point of $27,000 that could come into play.

The sentiment surrounding Bitcoin options appears to be mixed, with a current put/call ratio of 0.85 indicating a neutral to bearish outlook.

The max pain price, which is the strike price carrying the highest number of open Bitcoin options contracts, happens to be the price at which the most significant losses would be incurred by the highest number of contract holders at expiration. With 105,000 outstanding Bitcoin options contracts yet to be settled, the next batch of contract expiry with a similar Open Interest (OI) is set for May 26, as per Deribit.

Moreover, the put/call ratio is calculated by dividing the number of put (short) contracts traded by the number of call (long) contracts. A ratio of 1 means that trading is evenly balanced between sellers and buyers. A value below 1 is generally considered bearish since more speculators are shorting the asset than taking long positions.

On April 28, approximately 807,000 Ethereum options contracts are set to expire, with a max pain point of $1,850 and a notional value of $1.54 billion. The put/call ratio for ETH options is comparable to that of BTC contracts, standing at 0.8.

Options provide speculators with the choice to buy or sell assets at a specified price with the ability to sell the contracts at any time, offering more flexibility than futures contracts that have set expiration dates.

As of now, Bitcoin is trading at $29,506, having gained 1.4% in the past 24 hours. However, it is currently experiencing significant resistance at the $30,000 level, and it may face difficulty surpassing it. Furthermore, the expiration of Bitcoin options is unlikely to impact BTC prices over the weekend.

CME Group to Increase Options Expiries

CME Group, the world’s leading and most diverse derivatives marketplace, has recently announced its plans to expand its crypto options offering by introducing daily expiry options for its standard and micro-sized Bitcoin and Ethereum contracts, starting from May 22.

The move is expected to provide greater precision and versatility in managing short-term price risks for Bitcoin and Ethereum traders. CME Group’s Global Head of Cryptocurrency Products, Giovanni Vicioso, stated that the new daily options will allow market participants to customize their risk management strategies with more granularity and optimize their exposure to the volatile cryptocurrency market.

The decision to increase the options expiries is a part of CME Group’s ongoing effort to enhance its product offerings and meet the evolving needs of its customers. The company has been at the forefront of the institutional adoption of cryptocurrencies, offering Bitcoin futures contracts since 2017, which have seen robust growth and increasing demand from traders and investors.

With the expansion of its crypto options, CME Group aims to build upon its leadership position in the cryptocurrency derivatives market and cater to a broader range of market participants, from retail traders to institutional investors. The move is also expected to drive greater liquidity and price discovery in the cryptocurrency derivatives space, contributing to the maturation and mainstream adoption of digital assets.

Overall, CME Group’s decision to increase its options expiries is a significant step in the evolution of the cryptocurrency market, and it reflects the growing demand and interest in these crypto assets among traditional investors and traders.

According to Giovanni Vicioso, the Global Head of Cryptocurrency Products at CME Group, these new contracts will enable market participants to manage short-term Bitcoin and Ether price risks with greater precision and flexibility.